WHEN May 2026

WHERE Coral Gables Country Club (990 Alhambra Circle, Coral Gables, FL 33134)

THE EVENT

Autentico – the Italian Food & Wine Festival is the only high-end Food & Wine Festival in Miami that mainly focuses on Italian cuisine and flavors.

The Autentico – the Italian Food & Wine Festival presents two different sessions: the first one for food & wine professionals only, is meant to facilitate the interactions between Italian producers and U.S. buyers, while the second part of the event is a Grand Tasting, an opportunity for exhibitors to present their products to a selected public of local food lovers.

EXHIBITORS

Italian F&B producers, F&B importers, and distributors representing Italian brands, hospitality suppliers

Total stations expected: 40+

VISITORS

Hospitality industry (restaurant owners, chefs, beverage managers, buyers at hotels and restaurant chains), Cruise Industry, F&B visitors, F&B importers and distributors, influencers (journalists and food bloggers), and local consumers.

Total attendance expected:

- 150+ F&B professionals

- 800+ Food Lovers

LOCATION

The 6th edition of the Autentico – the Italian Food & Wine Festival will take place at the Coral Gables Country Club (990 Alhambra Circle, Coral Gables, FL 33134).

CLICK HERE TO KNOW MORE ABOUT THE LOCATION

PROGRAM

DAY 1: – Orientation Activities (Exhibitors Only)

- 10:30am-12:30pm | ORIENTATION MEETING: INTRODUCTION TO THE SOUTH FLORIDA MARKET

Presentation by U.S market experts + Industry Testimonials

(Optional activity dedicated to companies approaching the Florida market for the first time)

- 2:00pm-4:00pm | GROUP VISIT TO GOURMET MARKETS & GROCERY CHAINS

(Optional activity dedicated to companies approaching the Florida market for the first time)

- 7:00pm-9:00pm | LAUNCH DINNER

Including Meet & Greet and Speeches by top food & wine distributors

DAY 2: – Event Day

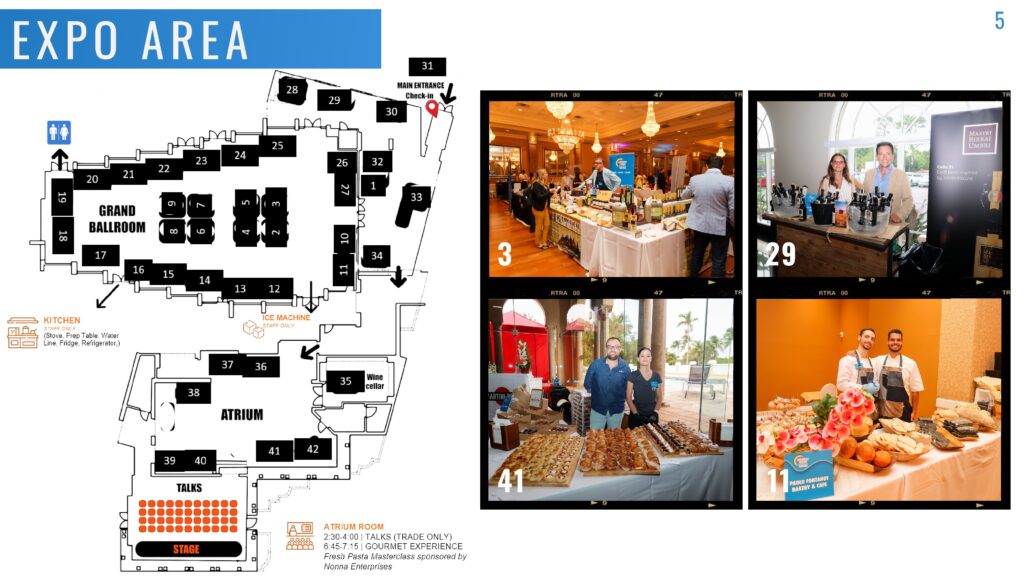

- 2:15pm-4:00pm | TALKS (F&B PROFESSIONALS ONLY)

Seminars on current relevant topics for the Food & Beverage industry

- 4:00pm-6:00pm | TRADE SESSION (F&B PROFESSIONALS ONLY)

Trade-only Networking in the expo area with Florida’s F&B importers/distributors, chefs, restaurateurs, and gourmet market owners.

- 6:00pm-9:00pm | GRAND TASTING FOR A SELECTED PUBLIC OF FOOD LOVERS

While tasting authentic Italian products and signature dishes, guests will have the opportunity to get to know more closely Italian culture and culinary tradition.

EXHIBITORS’ OPPORTUNITIES

IF YOU ARE AN ITALIAN FOOD & BEVERAGE PRODUCER

OR AN IMPORTER OF AUTHENTIC ITALIAN PRODUCTS

DO NOT MISS THIS UNIQUE OPPORTUNITY

TO SHOWCASE YOUR BRAND:

FOR FURTHER INFORMATION ON THE EXHIBITORS’ OPPORTUNITIES CONTACT

ALESSIA MARCENARO, DEPUTY EXECUTIVE DIRECTOR MARKETING@IACC-MIAMI.COM

INDUSTRY PROFESSIONALS REGISTRATION

IF YOU ARE AN IMPORTER/DISTRIBUTOR, RESTAURATEUR, CHEF, GOURMET MARKET OWNER, WINE SHOP OWNER, AND HOSPITALITY BUYER:

COMPLIMENTARY PROFESSIONAL REGISTRATIONS WILL OPEN IN 2026

Important note: industry professionals are guaranteed complimentary entrance to the event upon arrival before 5:00 pm

PAST EDITIONS

Watch here the recap video of the past editions:

- Autentico: The Italian Food and Wine Festival 2025

- Authentic Italian Food & Wine Festival 2024

- Authentic Italian Food & Wine Festival 2023

- Authentic Italian Food & Wine Festival 2022

- Authentic Italian Table – Food & Wine Festival 2019

- Authentic Italian Table 2018

AUTHENTIC ITALIAN FOOD & WINE FESTIVAL

Miami, maggio 2025

Presentazione:

Nel 2024, l’export italiano verso gli USA ha registrato una crescita significativa (+9,8%) rispetto al 2023, con un valore totale di 75 miliardi di dollari, di cui 8.45 miliardi nel settore agroalimentare, confermando il trend positivo degli ultimi anni. In questo contesto, lo Stato della Florida si conferma il terzo mercato per valore delle importazioni di prodotti agroalimentari italiani.

Le esportazioni italiane di prodotti alimentari e vino verso la Florida hanno registrato un significativo aumento del 28% rispetto al 2023, raggiungendo un valore complessivo di 557 milioni di dollari. Il prodotto italiano più esportato in assoluto in Florida è il vino, che da solo vale 253 milioni di dollari, seguito dalle acque minerali con 69 milioni. Al terzo posto troviamo le preparazioni a base di cereali e prodotti da pasticceria, che totalizzano 53 milioni, mentre al quarto posto si posiziona l’olio d’oliva con 49 milioni. Seguono i liquori con 45 milioni, le salse con 21 milioni e la pasta con 20 milioni. Chiudono questa classifica i formaggi, che raggiungono i 13 milioni di dollari, e il caffè con 12,5 milioni di dollari (Fonte ICE). Questa crescita è legata a diversi fattori, tra cui la sempre maggiore attenzione dei consumatori americani alla qualità, genuinità e tracciabilità dei prodotti. La Florida, con i suoi 23,5 milioni di abitanti e oltre 150 milioni di presenze turistiche annuali, rappresenta un mercato in costante espansione e con gusti sempre più sofisticati ed internazionali.

Miami, principale metropoli dello Stato, è ormai riconosciuta come una delle capitali gastronomiche degli Stati Uniti, grazie alla presenza di ristoranti internazionali, celebrity chef, festival culinari e gourmet markets specializzati in prodotti di eccellenza.

Per promuovere ulteriormente le eccellenze enogastronomiche italiane sul mercato di Miami, la Italy-America Chamber of Commerce Southeast organizzerà nel maggio 2025 la settima edizione dell’evento “Autentico: The Italian Food & Wine Festival”. L’evento prevede la partecipazione di circa 40 espositori e 200 importatori, distributori, ristoratori e chef della Florida, coinvolti in due giornate di incontri, seminari, degustazioni e networking con le aziende italiane presenti.

Per le aziende italiane del settore Food & Wine, questa rappresenta un’opportunità unica per entrare in contatto con controparti commerciali qualificate, esplorare un mercato in crescita e testare i propri prodotti durante il Grand Tasting, aperto al pubblico locale.

Programma della settima edizione di Autentico: The Italian Food & Wine Festival:

Giorno 1 – ATTIVITÀ ORIENTATIVE

- Incontro di orientamento: introduzione al mercato della Florida con esperti di settore americani e testimonianze aziendali di imprese italiane già operative.

- Visita guidata a gourmet market e punti vendita GDO di Miami.

- Cena di lancio: networking con autorità diplomatiche e importatori/distributori selezionati, con focus sui trend di mercato.

Giorno 2 – ATTIVITÀ PROMOZIONALI E COMMERCIALI

- Seminari tematici: approfondimenti sul settore F&B nelle navi da crociera e sull’evoluzione della ristorazione di alta qualità a Miami.

- Sessione Trade: incontri B2B tra espositori e visitatori professionali presso l’area espositiva (riservato ai professionisti del settore).

- Grand Tasting: apertura al pubblico di food lovers, con la partecipazione di ristoranti, pasticcerie e gelaterie che offriranno assaggi ai visitatori. Un’opportunità strategica per le aziende italiane di far conoscere i propri prodotti direttamente ai consumatori finali.

Per maggiori informazioni sull’evento e iscrizioni: Exhibitor Package

Le aziende italiane interessate a partecipare possono contattare la nostra Camera di Commercio all’indirizzo: marketing@iacc-miami.com

Ente organizzatore:

L’Italy-America Chamber of Commerce Southeast (IACCSE), con sede a Miami, è un’organizzazione statunitense senza scopo di lucro, ufficialmente riconosciuta dal governo italiano, che si dedica alla promozione del commercio tra Stati Uniti e Italia. Fondata nel 1991, la IACCSE fa parte di Assocamerestero, l’associazione delle Camere di Commercio Italiane all’Estero. Conta oltre 320 aziende associate, tra cui alcuni dei marchi più rappresentativi del Made in Italy negli USA. I soci operano in diversi settori, tra cui arredo-casa, ristorazione, meccanica e logistica.